What is Tweezer Bottom Pattern:

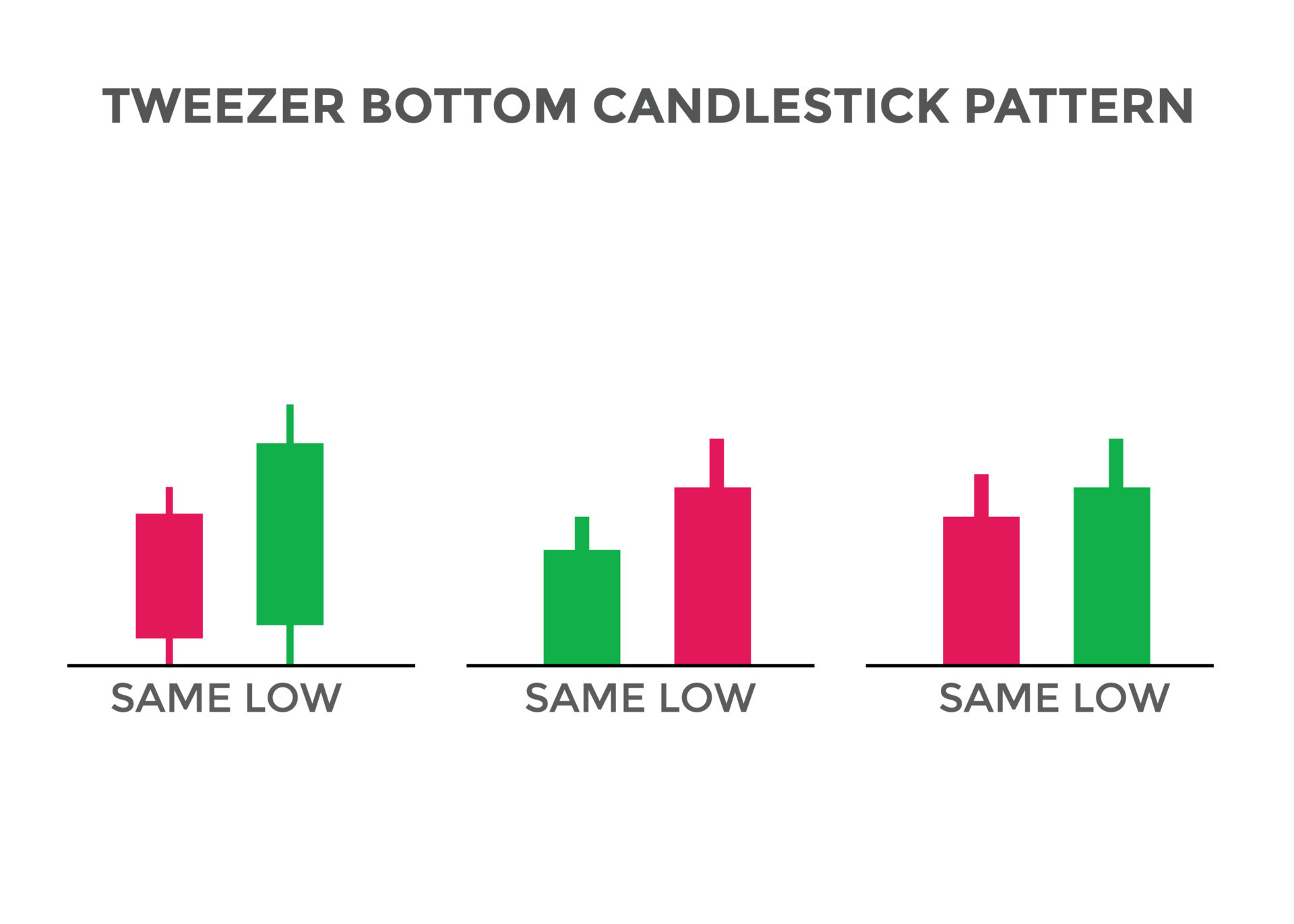

Tweezer Bottom namona aik ulta namona hai jo takneeki tajzia mein waqay hai, khaas tor par zar e mubadla ke bazaar mein. is mein do mom batian shaamil hain jin mein aik jaisi ya taqreeban aik jaisi kam vicks hoti hain, jo ghair mulki currency ke chart par aik dosray ke qareeb nazar aati hain. pehli mom batii ki chhari aam tor par aik bearish mom batii ki chhari hoti hai jo salahiyat mein kami ki nishandahi karti hai, jabkay doosri mom batii ki chhari aik taizi wali mom batii ki chhari hoti hai jo mumkina fashion ke ulat jane ka ishara deti hai. Tweezer Bottom namoonay ki tashkeel se pata chalta hai ke tanao ko farogh dena khatam ho gaya hai, aur khredar qeematon ko behtar bananay ke liye qadam barha rahay hain. tajir baqaidagi se is namoonay ki tashreeh is isharay ke tor par karte hain ke mumkina tor par taizi se tabdeeli anay wali hai. is sayaq o Sabaq par ghhor karna bohat zaroori hai jis mein Tweezer Bottom namona byorokrisi, jis mein mojooda fashion, help degree aur miqdaar shaamil hain, is ki ahmiyat ki tasdeeq karti hai .

Characteristics of Tweezer Bottom Pattern:

Tweezer Bottom ke namoonay ki khasusiyat do kaleedi af-aal ki madad se hoti hai : aik hi ya taqreeban aik hi kam vicks ke sath do mom btyon ki tashkeel aur bearish mom btyon ki chhari se taizi se mom btyon ki chhari mein tabdeeli. dono mom btyon mein yaksaa kmyan honi chahiye, jis se yeh zahir hota hai ke sharah ne do baar aik makhsoos support level ki jaanch ki hai lekin is ke neechay rukawat daalnay mein nakaam rahi hai. wohi kmyan bazaar ke jazbaat mein salahiyat ko tabdeel karne walay Ansar par zor deti hain, jis mein khredar fees ko ziyada badhaane ki taaqat haasil karte hain. Tweezer Bottom namoonay ki tashkeel ke sath wali miqdaar par aik nazar daalna zaroori hai, kyunkay ost se behtar miqdaar namoonay ki toseeq kar sakti hai. mazeed bar-aan, rujhan ziyada bara hai jab ke yeh taweel zawaal ke baad aur zar e mubadla ke chart mein ahem imdadi sthon ke qareeb nazar aata hai .

How to Identifying Tweezer Bottom Pattern:

Zar e mubadla ki tijarat mein Tweezer Bottom ka namona lainay ke liye, sarmaya car isi ya taqreeban aik jaisi kamiyon ke sath lagataar mom btyon ki talaash karna chahtay hain. pehli mom batii ki chhari mandi wali honi chahiye, jo farokht ke tanao ko zahir karti hai, jabkay doosri mom batii ki chhari taizi wali honi chahiye, jo bazaar ke jazbaat mein salahiyat ki tabdeeli ki nishandahi karti hai. dono mom btyon ki chharryan taqreeban aik hi muddat ki honi chahiye, jis se yeh zahir hota hai ke kharidaron ne is satah par qeemat mein madad ke liye qadam rakha hai. tajir Tweezer Bottom namoonay ki mojoodgi ki tasdeeq ke liye chart patteren, trained lines, aur madad / muzahmat ke darjay ke sath takneeki tajzia ke ozaar istemaal kar satke hain. ulat nishaan ki bunyaad par salahiyat ki tijarat ke imkanaat ke baray mein sochnay se pehlay namoonay ki toseeq karne ke liye doosri mom batii ki takmeel ke liye agay dekhna bohat zaroori hai .

Trading Strategy With Tweezer Bottom Pattern:

Tweezer Bottom patteren ghair mulki currency ke taajiron ke liye aik taaqatwar alamat ho sakta hai jo rujhanaat ke ulat jane aur imkanaat ke liye salahiyat ki kharidari ka faida uthany ki koshish kar rahay hain. kharidari aur farokht ka aik ghair mamooli tareeqa yeh hai ke Tweezer Bottom patteren dukhaay jane ke baad aik taweel kirdaar ada kya jaye, jis mein patteren ke zariye banaye gaye taaza tareen nichale hissay ke neechay stop las set ho. tajir kamyabi ki tabdeeli ke imkaan ko badhaane ke liye tasdeeq ki mom btyon par mushtamil mom btyon par mushtamil mom btyon par mushtamil mom btyon par mushtamil mom btyon par mushtamil mom btyon par bhi nazar rakh satke hain. mazeed bar-aan, khredar mukhtalif takneeki alamaat par mushtamil ho satke hain, jin mein transfer average ya oscalter shaamil hain, taakay Tweezer Bottom namoonay ke zariye faraham kardah reversal sign ki mazeed tasdeeq ki ja sakay. yeh zaroori hai ke market ke umomi halaat, rissk managment ke nazriaat, aur is waqt ke frame ko nah bhulen jis mein namona zahir hota hai jab mukammal tor par Tweezer Bottom patteren par mabni tijarti taknik ko nafiz kya jata hai .

Limitations and Risk of Tweezer Bottom Pattern:

Agarchay Tweezer Bottom ka namona forex trading mein salahiyat ke fashion ke ulat palat ke baray mein qeemti baseerat paish kar sakta hai, lekin yeh hudood aur khatraat ke baghair nahi hai. project ke aik aam sarmaya car ko ghalat intabahat ka saamna karna parta hai, jis mein namona sharah mein khatir khuwa tabdeeli ke nateejay mein nakaam rehta hai. is khatray ko kam karne ke liye, sarmaya karon ko Tweezer Bottom namoonay ki durustagi ki toseeq karne ke liye izafi takneeki tshkhisi alaat aur tasdeeq ke isharay istemaal karne chahiye. mazeed bar-aan, namoonay ki taseer market ke halaat, time frame, aur mukhtalif charge patteren ya isharay ki mojoodgi ke lehaaz se bhi mukhtalif ho sakti hai. taajiron ko charge ya ghair mutawaqqa ulat palat ke imkanaat se bhi aagah hona chahiye jo khatray se nimatnay ke munasib tareeqon par amal nah karne ki soorat mein nuqsaan ka baais ban satke hain. majmoi tor par, agarchay Tweezer Bottom ka namona salahiyat ke rujhan mein tabdeelion ka taayun karne ke liye aik mufeed zareya ho sakta hai, sarmaya karon ko ahthyat brtni chahiye aur is ki taseer ko badhaane aur khatraat ko kam karne ke liye usay aik mukammal tijarti tareeqa ke sath jorna chahiye.

Tweezer Bottom namona aik ulta namona hai jo takneeki tajzia mein waqay hai, khaas tor par zar e mubadla ke bazaar mein. is mein do mom batian shaamil hain jin mein aik jaisi ya taqreeban aik jaisi kam vicks hoti hain, jo ghair mulki currency ke chart par aik dosray ke qareeb nazar aati hain. pehli mom batii ki chhari aam tor par aik bearish mom batii ki chhari hoti hai jo salahiyat mein kami ki nishandahi karti hai, jabkay doosri mom batii ki chhari aik taizi wali mom batii ki chhari hoti hai jo mumkina fashion ke ulat jane ka ishara deti hai. Tweezer Bottom namoonay ki tashkeel se pata chalta hai ke tanao ko farogh dena khatam ho gaya hai, aur khredar qeematon ko behtar bananay ke liye qadam barha rahay hain. tajir baqaidagi se is namoonay ki tashreeh is isharay ke tor par karte hain ke mumkina tor par taizi se tabdeeli anay wali hai. is sayaq o Sabaq par ghhor karna bohat zaroori hai jis mein Tweezer Bottom namona byorokrisi, jis mein mojooda fashion, help degree aur miqdaar shaamil hain, is ki ahmiyat ki tasdeeq karti hai .

Characteristics of Tweezer Bottom Pattern:

Tweezer Bottom ke namoonay ki khasusiyat do kaleedi af-aal ki madad se hoti hai : aik hi ya taqreeban aik hi kam vicks ke sath do mom btyon ki tashkeel aur bearish mom btyon ki chhari se taizi se mom btyon ki chhari mein tabdeeli. dono mom btyon mein yaksaa kmyan honi chahiye, jis se yeh zahir hota hai ke sharah ne do baar aik makhsoos support level ki jaanch ki hai lekin is ke neechay rukawat daalnay mein nakaam rahi hai. wohi kmyan bazaar ke jazbaat mein salahiyat ko tabdeel karne walay Ansar par zor deti hain, jis mein khredar fees ko ziyada badhaane ki taaqat haasil karte hain. Tweezer Bottom namoonay ki tashkeel ke sath wali miqdaar par aik nazar daalna zaroori hai, kyunkay ost se behtar miqdaar namoonay ki toseeq kar sakti hai. mazeed bar-aan, rujhan ziyada bara hai jab ke yeh taweel zawaal ke baad aur zar e mubadla ke chart mein ahem imdadi sthon ke qareeb nazar aata hai .

How to Identifying Tweezer Bottom Pattern:

Zar e mubadla ki tijarat mein Tweezer Bottom ka namona lainay ke liye, sarmaya car isi ya taqreeban aik jaisi kamiyon ke sath lagataar mom btyon ki talaash karna chahtay hain. pehli mom batii ki chhari mandi wali honi chahiye, jo farokht ke tanao ko zahir karti hai, jabkay doosri mom batii ki chhari taizi wali honi chahiye, jo bazaar ke jazbaat mein salahiyat ki tabdeeli ki nishandahi karti hai. dono mom btyon ki chharryan taqreeban aik hi muddat ki honi chahiye, jis se yeh zahir hota hai ke kharidaron ne is satah par qeemat mein madad ke liye qadam rakha hai. tajir Tweezer Bottom namoonay ki mojoodgi ki tasdeeq ke liye chart patteren, trained lines, aur madad / muzahmat ke darjay ke sath takneeki tajzia ke ozaar istemaal kar satke hain. ulat nishaan ki bunyaad par salahiyat ki tijarat ke imkanaat ke baray mein sochnay se pehlay namoonay ki toseeq karne ke liye doosri mom batii ki takmeel ke liye agay dekhna bohat zaroori hai .

Trading Strategy With Tweezer Bottom Pattern:

Tweezer Bottom patteren ghair mulki currency ke taajiron ke liye aik taaqatwar alamat ho sakta hai jo rujhanaat ke ulat jane aur imkanaat ke liye salahiyat ki kharidari ka faida uthany ki koshish kar rahay hain. kharidari aur farokht ka aik ghair mamooli tareeqa yeh hai ke Tweezer Bottom patteren dukhaay jane ke baad aik taweel kirdaar ada kya jaye, jis mein patteren ke zariye banaye gaye taaza tareen nichale hissay ke neechay stop las set ho. tajir kamyabi ki tabdeeli ke imkaan ko badhaane ke liye tasdeeq ki mom btyon par mushtamil mom btyon par mushtamil mom btyon par mushtamil mom btyon par mushtamil mom btyon par mushtamil mom btyon par bhi nazar rakh satke hain. mazeed bar-aan, khredar mukhtalif takneeki alamaat par mushtamil ho satke hain, jin mein transfer average ya oscalter shaamil hain, taakay Tweezer Bottom namoonay ke zariye faraham kardah reversal sign ki mazeed tasdeeq ki ja sakay. yeh zaroori hai ke market ke umomi halaat, rissk managment ke nazriaat, aur is waqt ke frame ko nah bhulen jis mein namona zahir hota hai jab mukammal tor par Tweezer Bottom patteren par mabni tijarti taknik ko nafiz kya jata hai .

Limitations and Risk of Tweezer Bottom Pattern:

Agarchay Tweezer Bottom ka namona forex trading mein salahiyat ke fashion ke ulat palat ke baray mein qeemti baseerat paish kar sakta hai, lekin yeh hudood aur khatraat ke baghair nahi hai. project ke aik aam sarmaya car ko ghalat intabahat ka saamna karna parta hai, jis mein namona sharah mein khatir khuwa tabdeeli ke nateejay mein nakaam rehta hai. is khatray ko kam karne ke liye, sarmaya karon ko Tweezer Bottom namoonay ki durustagi ki toseeq karne ke liye izafi takneeki tshkhisi alaat aur tasdeeq ke isharay istemaal karne chahiye. mazeed bar-aan, namoonay ki taseer market ke halaat, time frame, aur mukhtalif charge patteren ya isharay ki mojoodgi ke lehaaz se bhi mukhtalif ho sakti hai. taajiron ko charge ya ghair mutawaqqa ulat palat ke imkanaat se bhi aagah hona chahiye jo khatray se nimatnay ke munasib tareeqon par amal nah karne ki soorat mein nuqsaan ka baais ban satke hain. majmoi tor par, agarchay Tweezer Bottom ka namona salahiyat ke rujhan mein tabdeelion ka taayun karne ke liye aik mufeed zareya ho sakta hai, sarmaya karon ko ahthyat brtni chahiye aur is ki taseer ko badhaane aur khatraat ko kam karne ke liye usay aik mukammal tijarti tareeqa ke sath jorna chahiye.

تبصرہ

Расширенный режим Обычный режим